Your cart is currently empty!

Selling to the EU After July 2021 VAT Changes

In 2021 the European Union has made drastic changes to the way it expects international sellers to process shipments bound for any of its member states. Whereas prior to July 2021, low value shipments (below an average threshold value of around 22 Euro) were able to be imported into the union tax and duty free, now even these shipments will be being taxed.

In addition to these sweeping changes in the tax/duty threshold, sellers who wish to continue importing must collect VAT directly for all customer orders valued below 150 Euro. However, while the European Union’s official messaging suggests this should be a simple and easy transition, anyone who decides to navigate the process will discover this isn’t so.

For starters, it makes sense to first break-down sellers into two categories:

- Marketplace sellers

- Direct sellers

Compliance to the new rules differs greatly depending on which category you belong to.

Marketplace sellers

Marketplace sellers are those who don’t sell directly and instead go through marketplaces (such as Amazon, Ebay, Etsy, etc). If you fit this category, then compliance with the new customs measures is primarily handled for you.

The marketplace is responsible for calculating, collecting, and remitting the VAT to the European tax authorities. As a seller, the only major differences you are likely to notice is several news line items on your invoices/packing-slips and a potential drop in your sales to Europe (as buyers take in the increased cost on their end).

Otherwise, it’s mostly business as usual and you can continue selling as long as the orders keep coming in.

Direct sellers

Direct sellers are those who operate their own online shop and manage their own platform (such as Shopify, WooCommerce, Magento, etc). For this category of sellers, things are quite a bit more complicated.

The complication comes from the fact that direct sellers now need to calculate, collect, and remit the corresponding VAT charges for each sale to the European Union. Sound simple so far? Well read on..

Issue #1 – Many different VAT rates

Fist, there is no standard VAT rate for all every country. Instead these rates differ from country to country and it’s your responsibility to make sure who have all the correct rates and continue to stay on top of any possible future changes as well.

This issue isn’t that great of a barrier though and for those sticking through, here is a spreadsheet with all the rates as of today (July 2021):

Issue #2 – Registering to collect

So you’ve managed to calculate and get VAT integrated into your website; great!

But before you can legally begin to collect, you must register with a EU member state. Here the European Union has decided to make things easy for sellers and allow registration with one single country. They’ve called this new registration scheme IOSS and made it sound like a super simple approach to complicate.

In theory, this streamline compliance framework should allow you to register with, for example, Ireland, and now you’re legally ready to collect VAT.

Unfortunately, things aren’t that simple.

If you do decided to try registering directly, you will soon receive a response advising that you as a business owner residing outside of the European Union are not able to register. On the one end, they want you to register and collect tax on their behalf, yet at the same time they don’t allow direct registration.

What’s the solution? Well, the solution here is that you need to find a company/representative in the EU to register on your behalf. In this arrangement, this third party then registers and becomes liable for any VAT you owe.

For the most part, these third parties are most likely to be accounting firms, like KPMG or Avalara. The catch is that these are big companies and this sort of international service doesn’t come cheap. For example, have a quick look at KPMGs pricing for this service:

And this is just the cost of registration in the service. The cost of filling isn’t displayed here, but comes to roughly about the same.

Unfortunately since this is a requirement for those importing small value good below the 150 Euro threshold, it may be hard to justify these cost for many smaller sellers.

Issue #3 – Remitting

Let’s say you made it past the previous two issues and you’ve been successfully collecting VAT. Now here’s the fun part, regular remittence and reporting of taxes to the EU is now another one of your responsibilities. Not only do are you going to have to stay on top of all the paperwork, you’re also going to have to consider any currency fluctuations you may encounter while you hold on to that VAT you’ve collected.

Issue #4 – Shipment processing

Another large unknown at this point relates to the treatment of VAT paid packages are the boarder. The official EU guidelines suggest that you must correctly submit VAT payment declaration electronically along with your shipments. However, from experience, most low cost couriers outside of the EU don’t yet support this functionality yet.

How I’ve managed to continue selling to the EU as a direct seller

Despite the barriers the European Union has put up, it’s still possible to navigate around them with enough effort.

My current working solution depends on a pay-as-you go VAT collection/remittence service provided by Taxamo called Taxamo Assure. This service is essentially a middle ground between a marketplace and direct registration.

With this setup, you as a direct seller, a responsible for calculating and collecting VAT. However, instead of having to register through a third-party to remit at a later time, you use Taxamo’s VAT number and pay the collected VAT directly to Taxamo at the time of shipment. At this point, Taxamo is now responsible for the outstanding liability to the EU government.

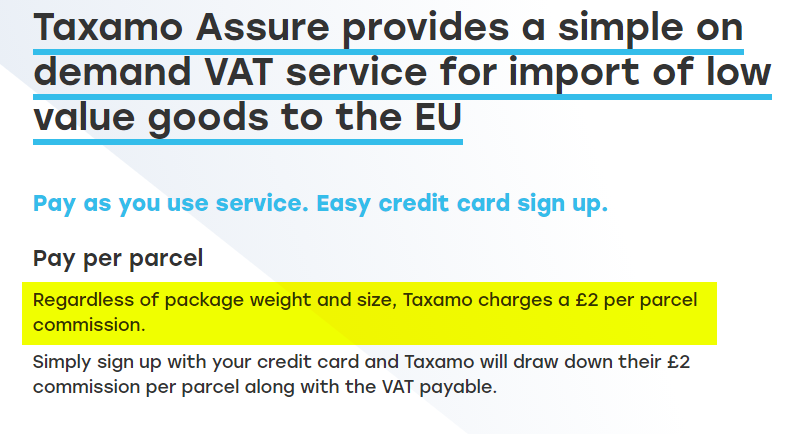

Taxamo isn’t a free service and still adds a significant cost to each small value shipment. Fortunately, Taxamo is a pay-as-you-go payment structure, so the costs can be gradually incorporated into your prices and you don’t have a large up-front cost.

Here is what their pricing looks like:

Given my sales calculation, the pay-as-you-go cost of Taxamo still works out to be significantly cheaper then KPMG even at higher sales volumes. Plus, you don’t actually need to deal with regular filling. This isn’t an advertisement for Taxamo by any means, but it’s just the most straightforward solution I’ve managed to find so far.

One big limitation of Taxamo Assure, is that they don’t have any ready to go plugins/modules for easy integration yet. Just direct API access and this may be a bit too technical for many direct sellers.

For example, for my WooCommerce stores, had to personally code a custom solution (drop a comment if you’re interested in a copy of the code).

When it comes to shipping, both USPS and Canada Post still don’t provide an official method for submitting VAT declaration for EU bound shipments. In an effort to work around this limitation, currently just mark all my shipments with a custom VAT paid sticker as visibility as possible.

Leave a Reply